Since we launched Splitwise, we have mostly focused on our core app: an expense-sharing platform for roommates and friends. What motivates us is the goal of improving relationships between friends. We make it easy for friends and family to organize shared bills, agree on what is fair, and be transparent with each other.

We realized one morning over coffee that the federal income tax system could use the Splitwise treatment. What do citizens think is a fair tax plan? How can we improve the quality of political debate and make taxes easier to talk about and vote on? We realized in our conversation that despite our passionate opinions on tax reform, we could not even remember what the tax rates actually are or where the brackets fall.

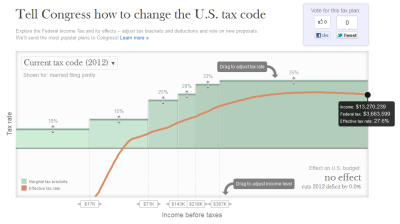

Enter the Splitwise Tax Fairness Project – a fun and educational way to visually modify and vote on tax proposals. Our in-house tax estimator, derived from IRS, Census, and NBER data, estimates the expected revenues from your tax plan. We are doing this as a non-partisan tax education project, and we plan to open-source our code so others can help us improve our tax model.

The idea of the Tax Fairness Project is to let Americans decide what is a prudent and fair tax code by letting anyone submit their own proposal. Visitors can play with the current tax code, see popular proposals and their impact on the budget, and vote on their favorite tax code through Facebook or Twitter. Splitwise will send the three most popular proposals to every member of Congress.

As President Obama and Governor Romney further outline their tax proposals, we will visualize them alongside top-voted user proposals.

Let us know what you think by commenting below, or email us at taxes@splitwise.com!

How can I add another tax bracket?

Your Tax Fairness Project app is a great idea, but it appears to limit marginal tax rates to only 50%. In fact, the highest marginal tax rate was 70% or above from 1936 to 1982, a period that includes the most robust sustained economic growth in US history. And according to Saez and Pikkety (http://www.nber.org/papers/w17616.pdf), a 70% rate now would not hamper growth and would increase equality. Is it possible to modify the app to allow for such a model?

We’ve just updated the infographic to allow marginal rates up to 75%. Give it a whirl and let us know if you have any other suggestions!

I noticed that the Saez and Pikkety paper I referenced is by subscription only–sorry! Jared Bernstein gives a good summary here: http://jaredbernsteinblog.com/optimal-research-on-optimal-taxation/

Thanks for the reference!

Would it be possible to have prior tax codes entered as a baseline? I’d be curious what it looked like under Reagan, Eisenhower and Clinton….

Great idea Dan! We’d like to add this over the next few days / week. A historical / current proposal view along side the user voted plans seems like a must-do.

How ambitious are you? Suppose you added alternative tax proposals — say, a form of VAT — with means to compare their effectiveness. This could elevate the tax debate to a new level.

Totally cool idea, but sort of a longer-term one. We thought about how we would add the Fair Tax, which is a VAT-like tax, but since it hasn’t seriously been part of the debate this election cycle and it was simpler to start by keeping it to income tax proposals. I think wrapping in how a potential VAT/Sales as well as the current Payroll, Corporate, and Estate taxes figure in to the overall system is a long term dream.

Reblogged this on Patos Papa.

Another possible addition to the tool (besides allowing higher marginal rates or more brackets) would be to allow for a negative income tax (i.e. one could pull the rates below zero for a bracket.

Cool idea – we’d have to think about how we’d want this to work (the EIC is basically a form of negative tax, but we don’t let users make changes to it right now). How does that interact with the standard deduction or exemption, for instance? It might be easiest for us to allow users to modify the EIC. We’ll think about it!

It would be nice also allow an option to modify the exclusion for employer provided health insurance. It is the largest tax expenditure, with the mortgage interest deduction coming in at #2.

Interesting, I’ll look into this.

JB

In you methodology section you note that you do not factor in economic effects – as those are best left to economomists – that debate is far less unsettled or complex than you think, even Romer reported significant economic impact from taxes on investment.

Regarldless – why not allow us to input our own economic effects – you allow us to set various tax rates, What about different economic impacts ? Though I would prefer to something where we could specifcy the negative economic effect of a dollar of taxes on each bracket even something as simple as a checkbox to factor in economic impact suing the Romer model

http://www.nber.org/digest/mar08/w13264.html

Thanks very much for the citation – that’s an interesting model I had not heard of previously, and looks like very cool research. It’s not clear to me, however, that it is simple or uncontroversial to apply Romer’s model specifically to all the kinds of tax changes we are allowing, as some kinds of taxes are likely to have different effects than others.

Allowing users to check a box on-or-off to assume Romer’s model in the advanced options seems like a very good idea. Perhaps you would like to help us implement this when we open source it? Please reach out to me at jon at splitwise.com if you have expertise in this area!

Adding the ability to add brackets would help, and being able to play with the standard deduction and exemptions would be nice. My idea involves having higher rates, but jacking the standard deduction up to about 12-20k

Thanks for this feedback Mike. I’ll try and put together a standard-deduction changer as soon as we are able, as that is a great idea. Maybe we can let folks add one more bracket, but I feel that allowing users to create many, many more brackets starts to make it hard to edit and absorb the plans in the first place.

Can I introduce more tax brackets (currently only six)?

This is being very frequently requested – we’re working on it.

Bug? Can’t view the other proposals, just the top 5. Screen returns to the default (current tax code).

Hope this helps. Fun tool.

Hey Phil – thanks for reporting. It works on our computers and we weren’t able to reproduce, but we’ve tried changing a few things – does it work now?

Love your tool. I wish you had an advanced option to remove all deductions. If I wanted to make a pure 10pct flat tax, no deductions allowed for anyone it won’t let me.

Hi Matt,

Great idea! We’ll definitely add this in the next release – I myself am curious how all deductions would turn out.

Still waiting for this feature. I have a plan similar to that of Matt A.

– eliminate ALL exemptions, deductions, credits and subsidies. No standard deduction, no mortgage interest deduction, no child credits, no retirement saving credits, no FSA/HSA etc.

– all the money one earns/ collects/ wins is taxable – no gimmicks, no adjustments – gross income is taxable income.

– 0% tax on first $40k (limit might be pegged to inflation).

– 20% tax on rest of the income (no upper limit).

Similar corporate tax code

– no deductions, subsidies

– 15% flat tax on income

This will achieve:

1. Removes arbitrary government meddling and price opacity.

2. Separates welfare programs (EIC, childcare etc) from taxcode.

3. Simplifies tax code and saves time for millions of americans.

4. Removes all holes and loopholes.

5. Removes marriage penalty.

6. My guess is this will increase revenue – but need to run the numbers with this tool.

Along with removing all deductions, exemptions and loopholes. I would also like to be able to make changes to the Capital Gains Tax to make it more progressive by adding more brackets. Right now if I remember correctly it is only two brackets with most people paying nothing on the low rate of 0% and above a certain amount you have to pay 28% (15% in the long term). If I am able to make it more progressive I would able able to raise the top rate in the long term for the very top earners while not having it to high for most people who do have to pay taxes on their capital gains.

Would be cool if you could add options that allow for us to offset revenue that is loss from our tax plan.

Also, maybe include taxes on corporations.

Great idea!

Here’s my tax plan – I couldn’t use your configurator to do it since there’s no corporate tax info in it.

End ALL corporate taxes. They are not people and shouldn’t pay taxes, nor should they feel the need to lobby for tax breaks, credits, or deductions. Take then completely out of the tax game.

Now, tax individual investment income at the same rates as individual employment income, and limit all personal deductions to a maximum of $100K.

Is it possible for someone to put Romney’s proposed plan in the choices?

you should update this to modern times. Include the ability to modify the corp tax rate, SALT deductions (including caps), etc…

It would be great if you would update this calculator for 2017. Specifically, add an option to adjust corporate tax rates, so we could try to devise a better, more broadly fair tax plan than that currently under consideration by Congress.