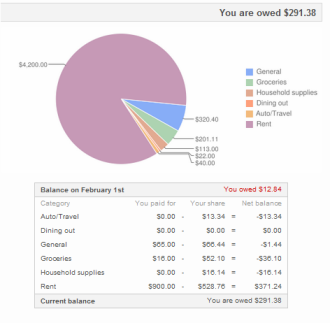

Since we launched Splitwise, we have mostly focused on our core app: an expense-sharing platform for roommates and friends. What motivates us is the goal of improving relationships between friends. We make it easy for friends and family to organize shared bills, agree on what is fair, and be transparent with each other.

We realized one morning over coffee that the federal income tax system could use the Splitwise treatment. What do citizens think is a fair tax plan? How can we improve the quality of political debate and make taxes easier to talk about and vote on? We realized in our conversation that despite our passionate opinions on tax reform, we could not even remember what the tax rates actually are or where the brackets fall.

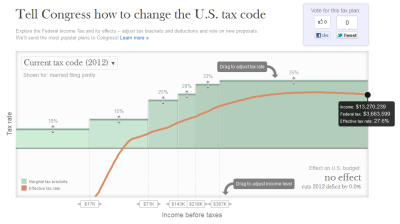

Enter the Splitwise Tax Fairness Project – a fun and educational way to visually modify and vote on tax proposals. Our in-house tax estimator, derived from IRS, Census, and NBER data, estimates the expected revenues from your tax plan. We are doing this as a non-partisan tax education project, and we plan to open-source our code so others can help us improve our tax model.

The idea of the Tax Fairness Project is to let Americans decide what is a prudent and fair tax code by letting anyone submit their own proposal. Visitors can play with the current tax code, see popular proposals and their impact on the budget, and vote on their favorite tax code through Facebook or Twitter. Splitwise will send the three most popular proposals to every member of Congress.

As President Obama and Governor Romney further outline their tax proposals, we will visualize them alongside top-voted user proposals.

Let us know what you think by commenting below, or email us at taxes@splitwise.com!

You must be logged in to post a comment.